Issue 21: Two communities, two debates: News coverage of soda tax proposals in Richmond and El Monte

Wednesday, February 26, 2014In the spring of 2012, the working-class city of Richmond, California, began receiving national attention when city officials decided to put a penny-per-ounce tax on sugary beverages before voters.1 Richmond City Council member and retired cardiologist Jeff Ritterman proposed the tax as a strategy to address rising obesity rates in the city. His concern stemmed in part from the fact that Richmond’s population is largely Latino and African American — groups that are disproportionately targeted with marketing for soda and other unhealthy foods linked to diabetes and other nutrition-related diseases.2

Later that summer, the Southern California town of El Monte placed a similar measure on its November ballot.3 El Monte was facing bankruptcy, and city officials intended to use the tax primarily to raise funds for vital city services, though Mayor Andre Quintero also acknowledged the importance of the tax for health programs3 in his predominately Latino city.4

Aware that if the measures passed, Richmond and El Monte could set a national precedent in soda regulation, the soda industry spent $4 million to defeat the two proposals over about six months.5 The industry’s huge investment brought national and international media attention to the small cities and made for the most expensive election in Richmond’s history6 and the costliest individual campaign in El Monte.3

Industry influence wasn’t the only hurdle the measures faced. A change to California’s tax law in the late 1970s limited Richmond and El Monte’s ability to designate tax revenue for a specific, health-oriented purpose. Passed in 1978, Proposition 13 required any tax raising funds for an earmarked purpose to receive two-thirds of the electoral vote, compared to just 50% of the vote if the revenue is not earmarked.7,8 As a result, in both Richmond and El Monte, revenues from the taxes were directed to the general fund.

Left vulnerable to critiques about how the money would be spent, tax proponents placed companion advisory policies on the ballot proposing that revenue from the tax should, if passed, go to youth obesity prevention programs in both cities10 and, in El Monte, to other city services as well.11 Both companion policies passed by wide margins in the election that fall; however, the ballot measures they accompanied were ultimately rejected (by 67% in Richmond and 77% in El Monte).12

Despite the defeat, public health advocates remain undeterred and view the Richmond and El Monte campaigns as important steps in the long march toward regulating sugary beverages. Advocates hold the strategy of taxing sugary drinks in high regard because of its potential to lower consumption of these harmful products and to raise money for critical obesity prevention programs.13Taxing harmful products is a well-documented strategy for improving public health outcomes: Evidence from the tobacco control movement, for example, shows that increasing cigarette taxes substantially reduced smoking rates.

Given the prominence of these two policy battles and the certainty that more will follow, we wanted to learn from newspaper coverage of the taxes how each side of the debate characterized its position. What stories did tax advocates and opponents tell in the news? How were the soda industry, its products and its spending characterized? Who was quoted in the coverage, and what did they say? What lessons can the coverage offer advocates to help strengthen efforts to regulate sugary beverages in other communities?

Why study the news?

One major role the news media play in a democratic society is setting the agenda for public policy debates.14-16 Journalists’ decisions about the many pressing issues and problems of the day can raise the profile of an issue, whereas issues not covered by the news media are often neglected and remain largely outside public discourse and policy debate.17,18

Although new media platforms are changing the way people consume the news, newspapers (including their online components) continue to influence local and national policy debate. The majority of newspaper readers are registered voters,19 and traditional news outlets remain a key source of information for the majority of news consumers.20 Newspaper coverage also helps advocates better understand the public debates surrounding their policy of interest.

Across all forms of media, social and health issues are “framed” or portrayed through a complex process of organizing information to create meaning.15,21,22As they cover stories, journalists select certain arguments, examples, images, messages, and sources to create a picture of the issue. The selection — or omission — of arguments and voices works like a frame around a picture, telling us what information is important and what information we can ignore. For example, people and viewpoints that are included in a news story are perceived as more credible than those that are excluded.

We are concerned with how the news frames public health and social justice issues because frames foster certain understandings and hinder others. Frames are powerful — often, all it takes is a single word or image to activate an entire frame that then determines the deeper meaning associated with that word or image. Once activated, frames trigger emotions, associations, values, and causal explanations. They create tracks for a train of thought — and once on that track, it’s hard to get off.

What we did

We searched the Nexis news database for English-language newspaper articles published online or in print between November 2011 and January 2013 that mentioned the Richmond and/or El Monte tax proposals. We supplemented this search with reviews of the online archives of English- and Spanish-language newspapers not included in the Nexis database that we knew from our daily media monitoring had reported on these campaigns. We also searched the online and print archives of industry trade press publications such as Beverage Digest.

We found a total of 547 news articles including English-language news, Spanish-language news, and industry publications. Because of the large number of English-language news articles, we selected for our sample every other English-language article from each database and news outlet. Since we identified only a small number of Spanish-language and industry press news pieces, we included all of these in our analysis. Our final sample included 218 articles (English-language, Spanish-language, and industry press) that substantively discussed the tax policies.

To determine how the pieces were framed, we first read a small number of stories to develop a preliminary coding instrument. Before coding the full sample, we used an iterative process and statistical test to ensure that coders’ agreement was not occurring by chance.

What we found

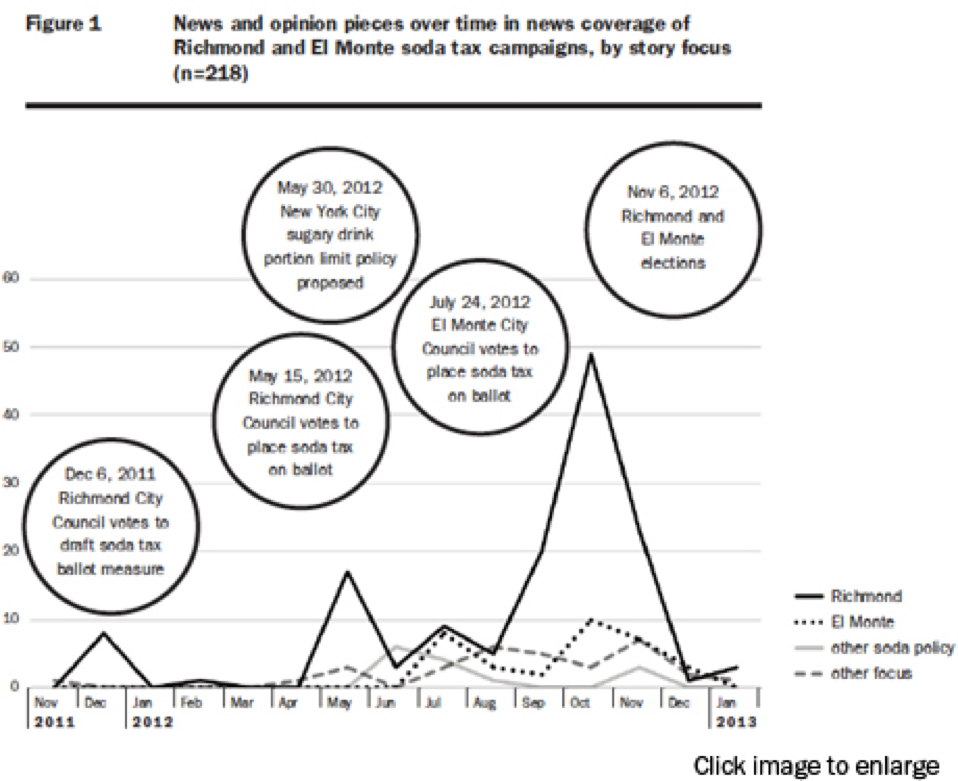

The majority of the news focused on the Richmond tax proposal: 64% of articles were about Richmond, compared with only 15% about El Monte; 6% were primarily about some other sugary drink policy (such as a soda size limit proposed by New York City’s then-Mayor Michael Bloomberg), while 15% of news stories had another focus, such as a profile of Jeff Ritterman, the city council member who developed, sponsored and promoted the Richmond measure.

The majority of the coverage was news (57%), while 43% was opinion writing, including letters to the editor, editorials, op-eds and blogs. Opinion coverage was more or less evenly divided: 44% of opinion pieces favored soda taxes, 39% opposed the policies, and 17% took a mixed or unclear position. However, all nine editorials took an anti-tax position.

News articles were evenly distributed across the year, but most of the opinion coverage appeared directly before and after the elections: 70% appeared between September and November 2012, with 40% appearing in October alone.

Tax proponents in Richmond made extensive use of the opinion space (including editorials and letters to the editor). By focusing their advocacy efforts primarily on the election period, public health advocates may have missed an opportunity to build on a groundswell of news coverage growing around sugar-sweetened beverage regulation that began earlier in the spring of 2012.

Who was quoted in the news?

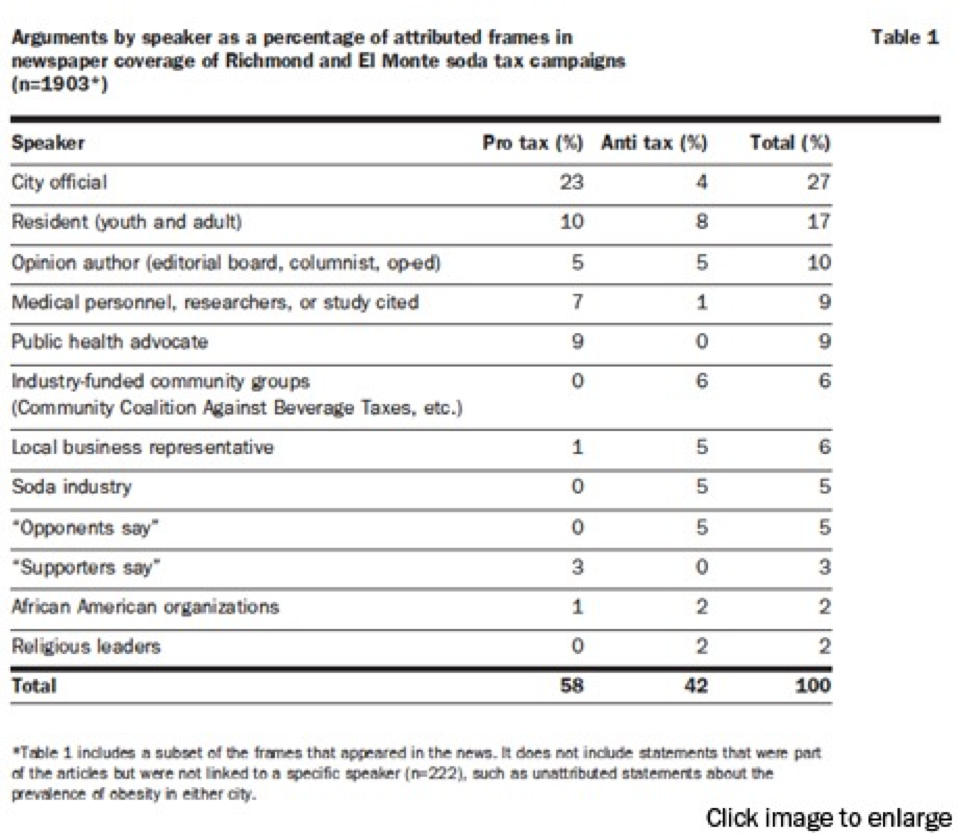

Most articles contained a variety of arguments. On average, each story contained nine arguments, for a total of 2,125. Table 1 lists the prevalence of these arguments according to the type of speaker who voiced them.

The most frequent speakers in the news were city officials, such as Richmond City Council member Jeff Ritterman, residents of the two cities and surrounding areas, opinion writers (including columnists and editorial boards), public health advocates, and doctors and medical researchers. City officials, public health advocates, and the medical community spoke overwhelmingly in favor of the tax, while community residents and opinion authors were more or less evenly split for and against the tax.

Speakers who were explicitly identified as representatives of soda companies or soda-affiliated organizations (like the American Beverage Association) comprised only 5% of total arguments (all anti-tax). However, the beverage industry also funded highly visible local anti-tax groups in both cities. Spokespeople for the beverage industry-funded El Monte Citizens Against Beverage Taxes and the Richmond anti-tax group Community Coalition Against Beverage Taxes expressed an additional 6% of anti-tax arguments. The industry-sponsored coalition in Richmond, whose primary news representative was Bay Area public relations consultant Chuck Finnie, included a broad swath of the community, particularly its African American community.23Among others, the coalition included Richmond officials (such as council member Corky Booze); local business owners; medical professionals (such as local doctor Brazell Carter); African American leaders (such as Lloyd Madden, president of the Black American Political Action Committee); community residents; and religious leaders. El Monte Citizens Against Beverage Taxes primarily included local businesses.*

At times, speakers from these coalitions were quoted in the news, but without industry affiliations. Therefore, Table 1 may somewhat underrepresent the presence of the Community Coalition Against Beverage Taxes, El Monte Citizens Against Beverage Taxes, and, by extension, the sugary drink industry, in the news.

The framing battle: Pro- and anti-tax stories in the news

We found 17 frames regarding the Richmond and El Monte soda taxes — nine supporting the tax and eight opposing it.

Frames supporting soda taxes

Overall, pro-tax arguments appeared more frequently than arguments urging the taxes’ defeat (63% vs. 37%). When pro-tax frames appeared, they were most often attributed to city officials, primarily Richmond City Council member Jeff Ritterman and El Monte Mayor Andre Quintero. Supporters told a story about soda taxes strengthening and protecting their community. To bolster this narrative, they used frames that centered on the potential health benefits taxes could produce, soda industry malfeasance during the tax campaigns, and the health harms caused by sodas themselves.

Tax will improve community health (15%)

Tax supporters described it as a “a tax to help people stay healthy.”24 Speakers who invoked this frame pointed out that, by increasing the price of sugary drinks, the tax could reduce consumption, raise money for local physical activity and other obesity prevention programs, and, ultimately, improve community health. Proponents such as Richmond resident Jonathan Perez made clear that the tax would be a small price to pay for a healthier, more robust community: “I think it’s worth paying a few cents to have more sports fields and recreational activities,” he said.25

Big Soda undermines democracy (13%)

This frame highlights how soda industry actions influence policy. Advocates used it to build opposition to the soda industry’s campaign activities by arguing that the industry overwhelmed Richmond and El Monte with anti-tax advertising. Some instances of this frame were neutral remarks from journalists describing the volume of industry campaign spending. Others were bold arguments, such as those made by El Monte’s mayor, who likened the industry’s flood of anti-tax advertising to a “siege”26 and suggested that the industry intended to “obliterate [the measure].” 27,28 Still other supporters argued that the soda industry did not truly care about the communities in which it was fighting the tax. For example, Richmond public health organizer Jenny Wang expressed anger that “[Richmond residents] are getting all these mailers funded by people from out of town who care nothing about Richmond.”24

Soda harms health (13%)

This frame points to sugary drinks as a leading cause of high rates of obesity and diabetes. Proponents highlighted research showing that sodas are uniquely harmful. For example, public health researchers frequently appeared in the news discussing how sodas contribute to weight gain, characterizing it as “public enemy number one”29 and a key “culprit in the obesity epidemic.”51 This framing helped advocates make a strong case for limiting access to sugary beverages, though the tax was not explicitly mentioned.

Obesity is a pressing problem (10%)

Though it does not explicitly reference a tax, this frame sounds an alarm, emphasizing that obesity is a serious problem that requires immediate action. Proponents pointed to rising obesity statistics to justify the taxes. Speakers emphasized statistics on obesity rates, both nationally and in Richmond or El Monte specifically, and discussed ailments associated with weight gain.

Tax opponents also occasionally invoked this frame when they were cited in statements like “Those on the other side of the debate don’t dispute that obesity rates are rising and cause for concern.”29 However, such acknowledgments were usually paired with arguments that the soda tax was not the appropriate solution to the problem.

Ripple effect (4%)

The “ripple effect” frame is a clarion call to action, inspiring residents with the promise that if a tax passed, their cities would set examples that could be emulated elsewhere. Evoking this frame, Harold Goldstein, executive director of the California Center for Public Health Advocacy, said, “The city of Richmond has an opportunity to make history. Cities and states will be watching this across the country.”30 After both taxes were defeated, a variant of this frame emerged in the coverage, casting the taxes’ defeat as “a template for a future battle”31 against soda in cities around the country.

Economic boon (3%)

Pro-tax arguments that focused on the economic benefits of the taxes were rare. They appeared most often in stories from El Monte, where supporters argued that a sugary drink tax would balance the city budget and “[address] long-term structural budget deficits. Without the additional revenue, El Monte officials have painted a bleak financial future.”32 This argument appeared less frequently in Richmond, where one example came from Mayor Gayle McLaughlin, who told reporters, “Instead of hurting businesses, we think [the tax] will help businesses.”33

Innovative and worthwhile policy (2%)

According to this frame, soda taxes are an innovative and valuable strategy that can help public officials fulfill their “moral imperative to address issues that are hurting and killing our community.”34 This frame asserted that the city government “had to start somewhere” in the fight against obesity.35,36 Speakers rarely invoked this argument for taxing sodas.

Business as usual (2%)

Similar to the “economic boon” frame, this position directly counters the anti-tax argument that soda taxes are bad for business; however, it does not explicitly discuss any benefits a tax would bring. Proponents argued that implementing a sugary drink tax would be “seamless and simple”37 and would not adversely impact local businesses. This argument was seldom used; when it did appear, it was almost exclusively in Richmond coverage.

Low-income communities of color benefit (1%)

Proponents of this frame asserted that the soda industry unfairly concentrates its advertising in low-income communities and communities of color — places where diabetes and related diseases are already more prevalent. Because of these inequities, supporters argued that taxing soda is a “good step toward improving health, particularly in low-income minority communities.”38 Jeff Ritterman invoked this frame to push back against opposition arguments that soda taxes are racist and regressive: “[Y]ou may call the tax regressive, but these diseases are regressive,” he said. “The beverage industry particularly targets our poor communities where they are advertising.”39

Frames opposing soda taxes

Opponents used the news to tell a story about soda taxes undermining and dividing the community. To support this narrative, they used frames that challenged the effectiveness of a soda tax, its impact on the economy, and its fairness to low-income residents of color. A broad range of spokespeople, including community residents, small business owners and religious leaders, voiced anti-tax arguments. Many of these speakers belonged to the industry- funded Community Coalition Against Beverage Taxes in Richmond and Citizens Against Beverage Taxes in El Monte.

Economic harm (12%)

This frame contends that soda taxes are a threat to the economy. Often, supporters of this frame focused on the taxes’ potential impact on local businesses, which speakers alleged could lose money if customers traveled to other cities to purchase soda. Richmond City Council member Nat Bates linked this frame to justice for local business owners when he said, “It is not fair to Richmond businesspeople. If there’s an extra tax here, people are just going to go to El Cerrito, San Pablo, or Pinole to do their shopping.”40 Businesspeople frequently invoked this frame, as when a local vending machine supplier caustically wondered, “How many boarded up businesses do [council members] want?”41

Other variants of this frame included arguments that the tax would mean “higher prices and higher grocery bills”35 for all consumers because store owners would be forced to raise the price of all foods or the price of necessary and popular health products, such as infant formula or nutritional supplements like Ensure. (From its inception, the El Monte measure included ballot language that exempted such products from being taxed.42 The Richmond City Council soon modified the language in its policy to include a similar exemption.43) Tax opponents who invoked this frame were particularly disapproving in light of the ongoing recession. One El Monte restaurant owner, for example, complained that his customers “don’t want to pay higher prices, and in this economy, fewer of them can actually afford to.”44

Ineffective solution (9%)

The “ineffective solution” frame suggests that, for a variety of reasons, soda taxes will not improve community health. Some speakers who invoked this frame, such as Richmond resident Keyannie Norford, argued that “raising prices will not stop people from handing over their cash at the register, and it will not stop obesity rates from rising.”45

This frame also links the tax to personal responsibility arguments that have been used in other debates to undermine support for policy solutions to health problems.46 These arguments assert that individuals are solely responsible for improving their own health through diet and exercise. Perhaps no phrase better distilled this frame than the statement of tax-opposing doctor Brazell Carter, who appeared in an industry-funded ad saying,”The tax will not make people healthier. Diet and exercise will make people healthier.”47

Racist and regressive (5%)

This frame links soda taxes to economic and racial injustice. Proponents of this frame characterized the soda tax as “a tax on poor people”33,48 that would “siphon money from [the] poorest residents.”38 Chuck Finnie, representing the Community Coalition Against Beverage Taxes, went so far as to describe the tax as an effort to “[balance] the budget on the backs of those who can least afford it.”49

Some tax opponents in Richmond took this frame a step further and described the tax not only as regressive, but also as a “racist ploy”50 that would “marginalize people of color.”51 This frame variant was laced with accusations of paternalism toward communities of color: One prominent Richmond church leader, for instance, dismissed the tax as an example of “others trying to tell residents in low-income communities of color what’s best for them.”52

Government intrusion (4%)

This frame portrays soda taxes as a barrier to personal choice. In El Monte, the coverage included many frames that characterized the proposed tax as government infringement into decisions that rightly belong with individuals or parents. As one local mother said, “[K]ids shouldn’t drink so much soda, but that’s the parents’ responsibility, not the city’s and not the mayor’s.”27 This frame appeared infrequently in Richmond coverage. When it did, tax opponents portrayed the tax as the beginning of a “slippery slope”53 that would end with government regulation of any number of foods5456 and the loss of personal freedoms.57

A blank check to city hall (3%)

The “blank check” frame asserts that voters can’t trust city officials to spend tax revenue as promised. Tax opponents argued that the ballot measures could not guarantee that the money raised by the tax would fund obesity prevention programs. Speakers who invoked this argument typically echoed the Richmond pastor who mused, “I do not think the money, or the majority of it, will be used for its intended purpose.”58 Speakers also used this frame to raise doubts about the motives and sincerity of soda tax advocates. El Monte Planning Commissioner Art Barrios accused tax advocates of proposing an “ill-conceived” ballot issue and then called their transparency and truthfulness into question: “They brought [the proposal] out as an anti-obesity measure, but that’s not what it was. It was strictly for revenue generation.”59

A variant of this frame holds that advocates and local politicians are behaving inappropriately. In these debates, speakers sometimes described tax advocates as “snake oil salesmen.”60 Chuck Finnie was among the most vociferous proponents of this frame, accusing Jeff Ritterman and soda tax advocates of “misleading voters” with “false claims.”61

Don’t blame soda (2%)

This seldom-used frame counters the research showing that sodas are a uniquely harmful contributor to obesity and related diseases.62-65 Speakers argued that, “in moderation, sugary drinks can be part of a healthy diet”66; that “soda is just one form of sugar delivery”53; and, ultimately, that “it’s neither fair nor wise to specifically target sodas for a special tax.”67

Soda industry defends the community (<1%)

This frame shields the industry against accusations of corporate malfeasance. When it appeared in mainstream newspaper coverage, proponents of this frame characterized the industry as a community defender intent on protecting residents from the misleading and costly half-truths of tax advocates. Chuck Finnie, for example, vowed that his industry-funded organization would “spend what is necessary to inform voters about a misleading and misguided tax that will cost Richmond residents and businesses millions of dollars a year.”68

This argument also appeared in the industry’s trade press, with speakers touting the industry’s overall commitment to fighting obesity and promoting healthy living. For example, one promotional blog from the American Beverage Association, the beverage industry’s trade group, trumpeted the “many meaningful initiatives [the] industry is leading to do its part to combat obesity,”69 suggesting that policy interventions such as taxation are unnecessary.

Obesity is not a priority (<1%)

While speakers rarely claimed obesity was not a problem, a few tax opponents argued that other issues were more deserving of city leaders’ attention. Indeed, one statement from the industry-funded Community Coalition Against Beverage Taxes called on the Richmond City Council to “pay attention to real problems like unemployment, violent crimes, and gangs.”70

Health vs. wealth: Differing tax rationales in the news

Richmond and El Monte’s proposals — and the news coverage they inspired — produced a range of pro- and anti-tax arguments that other places may anticipate in future soda tax fights. However, key arguments were used differently in the two cities, depending on the rationale for the proposal at the heart of the policy debate.

Advocates in Richmond, where the soda tax was proposed as a public health measure to counter rising obesity rates, more frequently referred to the health benefits of the tax and the programs it would support. Richmond council member Jeff Ritterman, the author of the proposal and a long-time cardiologist, was particularly vocal about the health benefits of the tax, arguing that it would create “a healthier future for our children.”9

In El Monte, city officials emphasized that the tax was first about raising revenue for the general fund and only second about improving health. Arguments framing the tax as a much-needed budget-balancing measure were dominant in El Monte, as when Mayor Andre Quintero said, “[T]here are significant financial hurdles that we need to start dealing with now, so having this type of tax as an option brings in revenue and hopefully encourages individuals to make healthier choices.”71 Economic arguments in support of the tax were largely absent in the Richmond coverage. When Richmond advocates did refer to the economy, it was usually to defend implementing the tax as a “seamless and simple”37 process — a counter to the industry’s allegations that it would be complex and financially ruinous for local businesses.

“Race-baiting in Richmond”

Though both Richmond and El Monte are working-class California cities with many residents of color and well-documented financial struggles, the debates and coverage about the soda tax poposals differed markedly in one key respect: Tax opponents in Richmond argued that the tax was racist or regressive, but these arguments rarely appeared in the El Monte coverage.

From the beginning, Richmond’s soda tax proposal was characterized by detractors as a “racist ploy”50 and a way to “marginalize people of color.”51 Tax opponents frequently accused proponents of paternalism as well. Nat Bates, a veteran city council member, described the Progressive Alliance (a group of predominantly white city council members who proposed the tax) as the Plantation Alliance72 and accused them of “using the black community to pass a measure for us without consulting us.”72 After the proposal was defeated, Lloyd G. Madden, president of the Black Political Action Committee, accused tax supporters like Jeff Ritterman of “disrespecting the Black community”73 by suggesting that its opposition to the campaign was industry-funded.

Some organizations representing Richmond’s African American community indeed may have rejected the tax on its own merit, but news coverage suggests that the claims of racism may have been politically motivated as well. “BMWL & Partners [the PR firm that represented the industry in the debate] was well aware of the racial divide within the city, and deftly exploited it,”23 wrote Bay Area reporter Wendi Jonassen, describing the process by which the beverage industry infiltrated the Latino and African American communities in Richmond.

In addition to advocating against the tax at culturally resonant city celebrations like Juneteenth and Cinco de Mayo,23 the industry quickly partnered with black community and religious leaders through the Community Coalition Against Beverage Taxes. The coalition included African American city officials (such as council members Corky Booze and Nat Bates); African American leaders (such as the head of the Black American Political Action Committee); community residents; doctors; and religious leaders. These leaders and their organizations often voiced anti-tax arguments that echoed the industry’s position, and their local affiliation may have boosted the effectiveness of these arguments in the public’s mind. Some reporters have suggested that these actions mean that the industry brought together these powerful community voices to “[drown] out” pro-tax arguments with arguments about race and class.23

Compared to how it handled issues of race and ethnicity, the beverage industry was much more upfront about its intention to use socioeconomic concens to minimize community support for the soda tax in Richmond. Chuck Finnie declared that one of the main points of the Richmond anti-tax campaign would be “that the tax will hit poorest residents the hardest.”74 To that end, industry allies, such as the Chamber of Commerce, used class warfare- style arguments about health advocates’ impure motives to cast themselves as a true friend to low-income community residents. For example, the industry-funded coalition accused tax proponents like council member Ritterman of “angling for national attention while giving short shrift to the poor and local business interests.”49 Similarly, council member Corky Booze regularly described the proposal as “a tax on poor people” that would, among other consequences, penalize residents who couldn’t afford to drive to neighboring cities to buy soda.33,48

Race and class debates rarely appeared in El Monte (<1% of total arguments). Newspapers only discussed the racial implications of the tax indirectly by occasionally reporting on the beverage industry’s multilingual anti-tax campaign.75 This campaign targeted different groups with claims that the tax would impact beverages, such as horchata and bubble tea, that are culturally relevant to specific ethnic communities. Arguments about the effects of a soda tax on low-income residents were similarly scarce in El Monte newspaper coverage.

Ultimately, in Richmond, the soda tax debate was imbued with racial and socioeconomic overtones that were not present in El Monte. The beverage industry’s framing of the soda tax as an issue grounded in racial and socioeconomic inequality was in part aided by many features unique to the city of Richmond, including its long history of struggles against corporate oil titan Chevron, its recent influx of progressive white civic leaders, and its long-standing racial divides. But as journalist Jonassen notes, the industry’s rhetorical strategies may well be repeated in any other city that “attempt[s] to levy taxes on large corporations that have a history of harming human health and the environment.”23

The long shadow of Proposition 13

California’s Proposition 13 has limited increases in property taxes and is widely credited for initiating the national anti-taxation movement in the late 1970s.76 The proposition did much more than that, however. Little-known Section 4 stipulates that local jurisdictions like cities or counties must have a two-thirds supermajority to pass new taxes when the revenues from the tax will go to a dedicated purpose instead of the general fund. This aspect of Proposition 13 affected both the soda tax proposals and the public debates in Richmond and El Monte.

Both city councils tried to pass taxes on sugary drinks that would go into the general fund, so that they only needed a simple majority to succeed. In Richmond, the purpose of the tax was to address chronic disease, so the city also placed a non-binding companion measure on the ballot advising the city council to use the money raised to fund sports and recreation programs.10 In El Monte, the tax was presented as a way to help the city balance its books, and its non-binding companion measure directed revenues to maintain basic city services in addition to establishing new health-related programs.11

Occasionally, the news coverage included quotes explicitly addressing how Proposition 13 influenced the structure of the proposals. In Richmond, for instance, council member Ritterman made the case for a tax that would flow to the general fund, saying “The $3 million which we expect to be generated will go into the General Fund. Otherwise we would need a 2/3 majority to pass the Soda Tax and we did not want 34% of the voters to be able to derail this important measure.”9

Far more often, opponents used the structure of the proposals to sow doubt about the purpose of the tax and impugn the motives of pro-tax advocates. In El Monte, because the tax was intended to fund a variety of city services, including health programs, opponents suggested that the policy was a thinly veiled money grab. For example, an advertisement from the “No on Measure H” campaign that was described in newspaper reports argued, “We’ve seen this before, the money from our taxes goes to the El Monte General Fund, and the politicians can use it for whatever they want.”75

In Richmond, opponents went even further. Because the tax was meant to support obesity prevention programs, industry-funded spokesperson Chuck Finnie critiqued the twostep process of raising the funds and then dedicating them for recreation programs by suggesting that advocates were lying to residents. “Not a single penny will go to anti-obesity programs, but the proponents are misrepresenting it to say it will,” Finnie said. “It goes to the general fund and will help close the deficit.”74

Recommendations for advocates

Though voters rejected the soda taxes proposed in Richmond and El Monte, this is a story that continues to evolve in California and around the country. Soda taxes are emerging as a promising tool for advocates seeking to protect the public’s health by limiting the availability of soda and other sugary drinks. Consequently, this story will keep unfolding as more cities across the country consider implementing a tax.

Advocates can learn from the challenging policy fights in Richmond and El Monte as they continue the public debate on this issue, being mindful of the fact that local circumstances, including the structure of the policies themselves, shaped the arguments that appeared in the newspaper coverage from each city. These unique circumstances had a bearing on the recommendations that we offer for advocates and journalists below.

One key lesson we’ve gleaned from our analysis of the debate is that having an overall strategy, building relationships with the community, and developing strong messages are necessary components of any successful campaign. We observed the soda industry rely on economic arguments and community support to build opposition to regulatory measures. As advocates develop stronger relationships with key community groups, they can shape their messages and dissemination strategies with community input, which will strengthen their efforts to rebut industry arguments and build support for taxing sugary drinks. In particular, advocates should:

Embed media advocacy strategies within a larger advocacy strategy

Part of the industry’s success was contingent upon having the right partners in place from early in the campaign. Soda tax supporters should embed their media strategy within a larger advocacy strategy that includes coalition-building across the community, whatever its particular needs may be. A diverse coalition with the capacity to make multiple arguments can make the case for community health to any audience. Having doctors, clergy, youth, parents, and other community allies as confident spokespeople will help residents understand the range of reasons for taxing sugary drinks to protect health.

Key to a successful larger advocacy strategy is a clear plan for how tax revenue will be invested. Polling data suggests that voter support for sugary drink taxes increases substantially when the revenues are dedicated to improve food and physical activity programs for young people.77 But advocates can only craft messages that reflect what is in the policy. In California, that meant that when the city councils opted to seek only a 50% majority, the revenues would go to the general fund. This decision left them vulnerable to damaging critiques about policy ineffectiveness, economic mismanagement and political maneuvering, despite the partner measures on each city’s ballot that would have directed how the city councils used the funds.

As communities grow more aware both of the harms of sugary drinks and the potential benefits of taxing them, it will become easier to build large-scale support for taxes. In California, for example, rising concerns about sugary drinks and support for soda taxes could help advocates achieve the supermajority needed for dedicated taxes.

Make soda industry spending and influence a part of the debate

Advocates can anticipate that policies to limit soda consumption will be met with well-funded opposition from the soda industry and its allies. The Richmond and El Monte soda taxes, as well as other policy battles in New York City,78 Philadelphia79 and elsewhere, point to an emerging soda industry playbook that includes using traditional advertising like billboards and TV ads, but also relies on extensive coalitionbuilding, funding local politicians and community groups, and creating locally focused “community” groups that act as the public face for their campaigns. Advocates can address these tactics by pointing out when the beverage industry is intruding into the community’s own decision-making and its efforts to create a healthy place to live. Such conversations about soda taxes can open the door to larger questions, such as how much influence major industries should have over our democratic process and over decisions about the public’s health.

Know your opposition and anticipate what they will say

The primary arguments against soda taxes that emerged from our analysis involved raising doubts about the taxes’ effectiveness and fomenting fears about economic consequences to struggling communities. As more soda taxes are implemented, evidence will accumulate regarding their influence on the health and fortunes of these communities. If soda taxes reap health and economic benefits similar to those of tobacco taxes, which have helped reduce smoking rates and prevented millions of premature deaths, advocates will be better poised to rebut industry claims.

In the meantime, advocates should be aware of the extent to which the soda industry may attempt, as it did in Richmond, to build opposition to soda taxes with arguments that they are harmful to low-income communities and/or communities of color. As part of a well-defined overall strategy, soda tax advocates can prepare to meet these challenges in part by building relationships with community stakeholders and coalitions that put forward strong counter-messages about economic and community health. For example, when confronted about the so-called regressive nature of soda taxes, some advocates have begun to counter that the diseases associated with soda consumption are, themselves,

Piggyback off of breaking news

Richmond and El Monte advocates did excellent work in generating a great deal of news coverage in the weeks leading up to the November 2012 election. But by focusing their advocacy primarily during the election period, advocates may have missed an opportunity to build on the groundswell of newspaper coverage around sugar-sweetened beverages that began earlier in the spring of 2012, following a series of regulatory proposals in California and beyond. These included the proposal of then-Mayor Michael Bloomberg’s soda size limit in New York City, a proposed soda tax in the Southern California city of Baldwin Park, and an effort by Los Angeles City Council member Mitch Englander to remove sugary drinks from vending machines in city parks and libraries. These incidents, though not directly related to the actions in Richmond and El Monte, were opportunities for advocates to draw connections between soda and health harms and to call attention to the growing national support for soda regulation.

As news coverage focuses on soda research and regulation in response to concerns about childhood obesity, tooth decay, and a variety of other health issues, advocates can leverage these stories. They represent opportunities to raise awareness of the health harms of soda, build support for soda tax policies, and reach out to possible coalition members even when an election or policy action is not imminent.

Use images and numbers to make your case

Creative visuals and numbers make stories more powerful and newsworthy. Soda tax advocates in Richmond were particularly adept at using evocative visuals. For example, council member Ritterman frequently pulled a little red wagon carrying 40 pounds of sugar, representing what a Richmond child consumes through sodas every year.80,81,82 It became a widely recognized icon of the campaign. Advocates should consider opportunities to use memorable visuals to convey their message. Social math can also help advocates add power to their arguments. Social math uses comparisons to put large numbers into an understandable context that clarifies their meaning to a wide audience.83 Dr. Wendel Brunner, the director of Contra Costa Public Health, called attention to skyrocketing soda consumption when he observed, “Our Richmond youth are consuming more than 150,000 calories of sweetened sugar drinks a year. That’s like 275 extra Big Macs a year.”5

Recommendations for journalists

The controversy surrounding soda taxes makes them newsworthy, and journalists play an important role in shaping the ongoing debate. The stories they write, the information they choose to include or exclude from those stories, the images they use, and the sources they interview or cite all influence both the opinions of policymakers and the general public. Some journalists who reported on the Richmond and El Monte soda taxes, notably those from publications like Richmond Confidential, went beyond the “he said, she said” controversy to reveal a complex story that illuminated the structural forces at play, including the behind-thescenes role the sugary beverage industry had in shaping both news coverage and public opinion. Journalists reporting on future soda tax battles can learn from such coverage to ensure that their reporting is complete, fair and accurate.

Based on our analysis of the Richmond and El Monte news coverage, we suggest the following ideas for journalists reporting on future soda tax stories:

Follow the money

Journalists sometimes used investigative techniques to tell a complex story about a powerful industry’s disproportionate spending to defeat the tax measures in the small cities of Richmond and El Monte. Journalists should be prepared to seek out spending data for such campaigns.

Reporters should also ask questions about where the money is going and how the soda industry benefits from these expenditures. For example, soda tax advocates in Richmond accused the soda industry of organizing and financing a multicultural “grassroots” opposition to the tax proposal. Reporting, especially from local sources, helped verify the advocates’ claim.

Resist the default frame

The soda industry has been successful in convincing both legislative officials and the general public that soda consumption is a matter of personal choice and that taxes interfere with that choice. This frame or belief system permeates U.S. society. However, what is often left out of that frame is a picture of the environment in which those “choices” are made. Many communities across the country are saturated with both sugary beverages and the aggressive marketing of these products, particularly low-income neighborhoods and communities of color. Stores in these communities sometimes sell soda for less than bottled water. Other pricing strategies promote outrageously large serving sizes.

These are but a few examples of how the soda industry has built an environment that undermines health. Journalists should consider factors such as neighborhood saturation of soda and junk food advertising, the quality of local drinking water, and local school vending machine policies to be sure the environment surrounding individuals is well explained and well illustrated.

Make sure authentic voices are represented

The soda industry’s primary “face” in news coverage was not company or trade association executives, but rather community residents, public relations spokespeople and other voices that were distanced from the industry. In Richmond, the industry- funded Community Coalition Against Beverage Taxes brought together many leaders from the African American community, who called the tax proposal racist and regressive. Although these were voices of community members, tax supporters assert that many were part of an orchestrated strategy by the soda industry to defeat the measure. Critics say the soda industry deliberately formed the coalition to take advantage of existing racial tension in Richmond.

Ultimately, there were countless voices from both inside and outside the Richmond and El Monte communities that were excluded from the coverage. Reporters should look for the source behind the source and unearth various perspectives from residents.

Investigate claims both about the tax’s health benefits and its economic impact

Soda taxes with the express purpose of benefitting health have yet to be enacted in the United States. In this new territory, there are claims from both sides that need investigating. Economic arguments opposing the tax included its potential to harm local businesses by forcing storeowners to raise the price of all food or increase the price of vital health products, such as infant formula or dietary supplement drinks. Analysis revealed that these claims were mostly unfounded. Reporters can investigate claims made by both sides. They should ask, for example, If soda taxes are implemented, how will we know if they are working? What evidence do supporters have that the tax will benefit health?

Ask what’s at stake

Soda’s contribution to the nation’s obesity epidemic is gaining attention. This, along with changing consumer tastes, has led to dramatic drops in sugary beverage consumption. It’s no wonder the soda industry has matched its marketing with equally aggressive efforts to fight any policies aimed at restricting the sales or marketing of its products: What’s at stake is industry profits. This should provide plenty of fodder for supplemental business stories in soda tax coverage.

For soda tax advocates, what’s at stake is the health of hundreds of thousands of children and adults. There are countless stories for health and science reporters to tell about the continuing impact of sugar on communities across the country. As new data are released and new studies conducted, there will be new health dimensions for reporters to explore.

Conclusion

Newspaper coverage of the Richmond and El Monte proposals differed in several key respects. El Monte’s policy was framed as an economic issue. In Richmond, tax proponents focused on the potential health benefits of taxing soda. Additionally, the debate in Richmond was explicitly racialized, in contrast to the conversation around El Monte’s tax. This finding may reflect the industry’s efforts to take advantage of existing racial tension in Richmond. There, the industry used the Community Coalition Against Beverage Taxes to rally leaders from the African American community and portray the tax as racist.

In both communities, the news regularly discussed the soda industry and its actions during the campaign. The industry’s primary “face” during the debates was not company or trade association executives, however, but rather community residents, public relations executives, and other speakers at a distance from the beverage industry. The industry and its affiliated speakers did not dispute the obesity epidemic and, at least in these campaigns, rarely questioned the health harms of their products. Instead, the bulk of arguments from industry-funded speakers focused on the ineffectiveness of the policies and the economic damage they would cause the communities.

Despite the defeats in Richmond and El Monte, momentum is building for taxing sugary drinks. In 2013, the Mexican government approved a national soda tax, drawing international attention.84 In the U.S., states like Vermont85 and Hawaii86 have debated soda taxes, and there has been interest from big cities like Philadelphia87 and San Francisco88 to small towns like Telluride, Colorado.89

Garnering support for any policy — especially a controversial policy like a tax — takes time. We didn’t get seat belts or airbags in vehicles without a long fight; it took time to move from “one for the road” to strict laws about drinking and driving; and oil companies didn’t take lead out of gasoline the first time public health advocates asked. Even the road to tobacco control’s current standing as a beacon of public health success took time. And when success did come, it came from unexpected places. For example, after the defeat of clean air ordinance proposals in Los Angeles, California, and Dade County, Florida, Duluth, Minnesota, celebrated the passage of one of the first smoke-free restaurant ordinances in 2001, despite heavy opposition from the tobacco industry.90 Small locales are often the first to enact big public health policies.

The same is likely to be true for soda taxes. The news coverage of the soda tax proposals in Richmond and El Monte shows us that, while the battle will be difficult, support for policies with the potential to “repair some of the damage caused by sugary drinks”91 exists and may be growing.

Acknowledgements

Issue 21 was written by Pamela Mejia, MS, MPH; Laura Nixon, MPH; Andrew Cheyne, C.Phil; Lori Dorfman, DrPH; and Fernando Quintero, BA. Thanks to Rebecca Womack and Sandra Young for their contributions to the research and to Heather Gehlert, MJ, for editing assistance. This research was supported by the Healthy Eating Research program of the Robert Wood Johnson Foundation and by The California Endowment. We thank the staff of the California Center for Public Health Advocacy, especially Harold Goldstein and Stefan Harvey, for their insights and feedback during the development of this study. Issue is edited by Lori Dorfman.

© 2014 Berkeley Media Studies Group, a project of the Public Health Institute

References

* The beverage industry removed the campaign websites for the Community Coalition Against Beverage Taxes and El Monte Citizens Against Beverage Taxes. For a complete listing of the membership of these coalitions, please see our preliminary news analysis, available at http://bmsg.org/resources/publications/soda-tax-debates-news-coverage-of-ballot-measures-in-richmond-and-el-monte-california-2012/.

1 Vara V. (2012, August 12). Campaign over soda tax bubbles up. Wall Street Journal. http://online.wsj.com/article/SB10000872396390443545504577567600004302574.html. Accessed April 9, 2013.

2 Jones C. (2012). Richmond soda tax to fight obesity makes ballot. San Francisco Chronicle. http://www.sfgate.com/health/article/Richmond-soda-tax-to-fight-obesity-makes-ballot-3564500.php. Accessed December 6, 2013.

3 Pamer M, Lopez L. (2012, July 24). El Monte declares fiscal emergency, can put soda tax on November ballot. NBC 4: Southen California. http://www.nbclosangeles.com/news/local/El-Monte-to-Weigh-Soda-Tax-to-Address-Fiscal-Woes-163637306.html. Accessed December 6, 2013.

4 United States Department of Commerce: United States Census. (2010). Community facts: El Monte CA. http://factfinder2.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=DEC_10_DP_DPDP1. Accessed December 6, 2013.

5 Zingale D. (2012, December 9). Gulp! The high cost of Big Soda’s victory. Los Angeles Times. http://articles.latimes.com/2012/dec/09/opinion/la-oe-zingale-soda-tax-campaign-funding-20121209. Accessed December 6, 2013.

6 Hobbs S, Witte R, de Leon R, Kanhema T. (2012, November 8). Election recap: Voters seek familiar faces. Richmond Confidential. http://richmondconfidential.org/2012/11/08/election-recap-voters-seek-familiar-faces/. Accessed December 13, 2013.

7 Amador Valley Joint Union High School District v. State Board of Equalization, 22 Cal. 3d 208, 231 (1978).

8 CA Const. art. XIIIA, 4.

9 Smith C, Ritterman J. (2012, September 30). Point-counter point: Richmond Measure N soda tax. Halfway to Concord. http://www.halfwaytoconcord.com/point-counter-point-richmond-measure-n-soda-tax. Accessed February 25, 2013.

10 Smart Voter. (2012, December 1). Measure O: Business license fee advisory measure – City of Richmond. http://www.smartvoter.org/2012/11/06/ca/cc/meas/O/. Accessed December 6, 2013.

11 Smart Voter. (2012, December 2). Measure H: El Monte sugar sweetened beverage business license fee measure – City of El Monte. http://www.smartvoter.org/2012/11/06/ca/la/meas/H/. Accessed December 6, 2013.

12 Satran J. (2012, November 7, 2012). Soda taxes shot down by voters in two California towns. Huffington Post. http://www.huffingtonpost.com/2012/11/07/soda-taxes_n_2088170.html. Accessed December 6, 2013.

13 Goldstein H, Wood C, Serpas S. (2013, May 16). Soda tax is a critical part of obesity solution. U-T San Diego http://www.utsandiego.com/news/2013/may/16/soda-tax-is-a-critical-part-of-obesity-solution/all/. Accessed November 25, 2013.

14 Dearing JW, Rogers EM. (1996). Agenda-setting. Thousand Oaks, CA: Sage.

15 Gamson WA. (1992). Talking politics. New York, NY: Cambridge University Press.

16 McCombs M, Shaw D. (1972). The agenda-setting function of mass media. Public Opinion Quarterly; 36(2): 176- 187.

17 McCombs M, Reynolds A. (2009). How the news shapes our civic agenda. In J Bryant and M Oliver (Eds.), Media effects: Advances in theory and research (p. 1-17). New York, NY: Taylor & Francis.

18 Scheufele D, Tewksbury D. (2007). Framing, agenda setting, and priming: The evolution of three media effects models. Journal of Communication; 57(1): 9-20.

19 Newspaper Association of America. (2012, February 15). Newspaper readers vote, and voters read newspapers. http://www.naa.org/News-and-Media/Press-Center/Archives/2012/Newspaper-Readers-Vote-and-Voters-Read-Newspapers.aspx. Accessed December 6, 2013.

20 Sasseen J, Olmstead K, Mitchell A. (2013). Digital: As mobile grows rapidly, the pressures on news intensify. In The state of the news media 2013: An annual report on American journalism. The Pew Center Project for Excellence in Journalism. http://stateofthemedia.org/2013/digital-as-mobile-grows-rapidly-the-pressures-on-news-intensify/. Accessed January 13, 2014.

21 Entman R. (1993). Framing: Toward clarification of a fractured paradigm. Journal of Communication; 43(4).

22 Iyengar S. (1991). Is anyone to blame? How television frames political issues. Chicago, IL: The University of Chicago Press.

23 Jonassen W. (2013, January 23). Race-baiting in Richmond. East Bay Express. http://www.eastbayexpress.com/oakland/race-baiting-in-richmond/Content?oid=3441871. Accessed April 9, 2013.

24 Kanhema T. (2012, October 22). Richmond residents say goodbye to soda at Measure N campaign event. Richmond Confidential. http://richmondconfidential.org/2012/10/22/richmond-residents-say-goodbye-to-soda-at-measure-n-campaign-event/. Accessed February 25, 2013.

25 Pulido T. (2012, November 7). Soda tax lost, but Richmond still won (sort of). Richmond Pulse. http://newamericamedia.org/2012/11/soda-tax-lost-but-richmond-still-won-sort-of.php. Accessed December 6, 2013.

26 Beverage industry spending millions to defeat Richmond soda tax. (2012, October 9). CBS San Francisco. http://sanfrancisco.cbslocal.com/2012/10/09/beverage-industry-spending-millions-to-defeat-richmond-soda-tax. Accessed February 19, 2013.

27 Allen S. (2012, October 29). Ad blitz aims to drown soda tax: El Monte mayor saw measure as a slam dunk. Then the drink makers declared war. Los Angeles Times, A1.

28 Early S. (2012, November 7). Getting into bed with Big Soda: How labor helped win a vote for more obesity. Huffington Post. http://www.huffingtonpost.com/steve-early/richmond-soda-tax_b_2089732.html. Accessed February 20, 2013.

29 de Leon R. (2012, October 31). Election 2012: Measure N and Measure O. Richmond Confidential. http://richmondconfidential.org/2012/10/31/election-2012-measure-n-and-measure-o/. Accessed February 25, 2013.

30 Aliferis L. (2012, May 16). Richmond voters will decide on “soda tax.” KQED: State of Health. http://blogs.kqed.org/stateofhealth/2012/05/16/richmond-voters-will-decide-on-soda-tax/. Accessed May 5, 2012.

31 Barrera E. (2012, December 15). Sugary drinks are a health hazard. Pasadena Star News.

32 Velazquez M. (2012, October 8). El Monte to spend roughly $100,000 to place “soda tax” on special election ballot. San Gabriel Valley Tribune.

33 Jones C. (2012, May 17). Obesity fight: Tax on sodas going on ballot; Richmond. San Francisco Chronicle, A1.

34 Velazquez M. (2012, July 25). El Monte moves forward with soda tax, voters to decide in November. San Gabriel Valley Tribune.

35 Drange M. (2012, November 2). Soda industry pours millions into campaign to defeat Richmond soda tax. The Bay Citizen. http://www.baycitizen.org/news/elections/beverage-makers-pour-money-campaign-soda. Accessed February 19, 2013.

36 Hurd C. (2012, October 29). Richmond considers taxing sugary sodas. NBC Bay Area. http://www.nbcbayarea.com/news/local/Richmond-Considers-Taxing-Sugary-Sodas-176369551.html. Accessed February 19, 2013.

37 Rogers R. (2012, October 24). Questions abound over collection of proposed “soda tax” on Richmond businesses. San Jose Mercury News.

38 Rogers R. (2012, August 29). Actor Danny Glover comes out in support of Richmond soda tax ballot measure. Contra Costa Times.

39 Whitney S. (2012, July 7). Debate pops over Richmond soda tax. Post News Group. http://www.postnewsgroup.com/publishedcontent/2012/07/21/debate-pops-over-richmond-soda-tax/. Accessed February 19, 2013.

40 Geluardi J. (2012, October 24). The Richmond soda war. East Bay Express. http://www.eastbayexpress.com/oakland/the-richmond-soda-war/Content?oid=3371994. Accessed February 26, 2013.

41 St. George Z. (2012, October ). Soda sellers decry proposed fee. Richmond Pulse.

42 Rogers R. (2012, October 5). Richmond “soda tax” ballot measure criticized as too broad. San Jose Mercury News. http://www.mercurynews.com/breaking-news/ci_21695123/richmond-soda-tax-ballot-measure-criticized-toobroad. Accessed May 21, 2013.

43 Goins J. (October 11, 2012). Sugar-sweetened beverage policy. City of Richmond. http://www.ci.richmond.ca.us/DocumentCenter/Home/View/9377. Accessed January 15, 2014.

44 Ballesteros-Coronel M. (2012, October 10). Empresarios de El Monte se oponen a Medida H. La Opinion. http://www.laopinion.com/article/20121010/IMPORT01/310109874. Accessed January 15, 2014.

45 Norford K. (2012, October). The soda tax: Missing the point? Richmond Pulse.

46 Dorfman L, Wallack L, Woodruff K. (2005). More than a message: Framing public health advocacy to change corporate practices. Health Education & Behavior; 32(4): 320-336.

47 de Leon R, St. George Z. (2012, November 6). Richmond residents vote down Measure N. Richmond Confidential. http://richmondconfidential.org/2012/11/06/measure-n-likely-to-fail/. Accessed February 25, 2013.

48 Calif. city puts soda tax on Nov. ballot. (2012, May 19). Santa Monica Daily Press, 9.

49 Rogers R. (2012, August 23). Big money from Big Soda sloshes around Richmond’s controversial sugar-tax measure. Contra Costa Times.

50 Whitney S. (2012, May 16). Soda tax voted on to Richmond ballot. Richmond Confidential. http://richmondconfidential.org/2012/05/16/soda-tax-voted-on-to-richmond-ballot. Accessed February 25, 2013.

51 Kenyon A. (2011, December 13). Richmond moves forward with soda tax. The Bay Citizen. http://www.baycitizen.org/news/health/richmond-soda-tax-obesity-health. Accessed February 19, 2013.

52 Rogers R. (2012, October 7). Beverage industry goes all out to defeat Richmond soda tax measure. Contra Costa Times.

53 Contra Costa Times Editorial Board. (2012, September 10). We recommend voters reject Richmond’s proposed soda tax. Contra Costa Times.

54 San Francisco Chronicle Editorial Board. (2012, May 18). No on soda tax: On the Richmond proposal. San Francisco Chronicle, A15.

55 Marlow M. (2011, December 16). My word: Soda tax not a solution to obesity. Contra Costa Times.

56 Suwalsky A. (2012, September 21). Richmond: At the forefront of the childhood obesity discussion. Richmond Pulse. http://richmondpulse.org/at-the-forefront/. Accessed February 26, 2013.

57 Goltz L. (2011, December 17). Guest commentary: A tax on soda, when does it end? Contra Costa Times.

58 Croom K. (2012, September 28). Pastor Jones: City has imposed fees and closed recreation facilities, making it harder to fight obesity. Post News Group. http://postnewsgroup.com/blog/2012/09/28/pastor-jones-city-has-imposed-fees-and-closed-recreation-facilities-making-it-harder-to-fight-obesity/. Accessed December 12, 2013.

59 McNary S. (2012, November 7). Measure H: El Monte soda tax fizzes out in face of $1.3 million opposition campaign. Southern California Public Radio. http://www.scpr.org/blogs/politics/2012/11/07/10939/measure-h-elmonte-soda-tax-fizzes-out-face-13-mil/. Accessed February 19, 2013.

60 Carter B. (2013, January 5). Dr. Brazell Carter: Where do we go from here on combating obesity? Contra Costa Times.

61 Harless W. (2012, August 9). Soda industry outspends beverage tax supporters 10-1 in Richmond. California Watch. http://californiawatch.org/print/17454. Accessed February 20, 2013.

62 Ebbeling C, Willett W, Ludwig D. (2012). The special case of sugar-sweetened beverages. In K Brownell and M Gold, (Eds.), Food and addiction: A comprehensive handbook (p. 147-153). New York, NY: Oxford University Press.

63 Ludwig D, Peterson K, Gortmaker S. (2001). Relation between consumption of sugar-sweetened drinks and childhood obesity: A prospective, observational analysis. The Lancet; 357(9255): 505-508.

64 Babey SH, Jones M, Yu H, Goldstein H. (September 2009). Bubbling over: Soda consumption and its link to obesity in California. California: UCLA Center for Public Health Policy Reseach, California Center for Public Health Advocacy.

65 Woodward-Lopez G, Kao J, Ritchie L. (2011). To what extent have sweetened beverages contributed to the obesity epidemic? Public Health Nutr; 14(3): 499-509.

66 Croom K. (2011, December 18). City Council proposes sugar sweetened beverage tax. Richmond Pulse. http://richmondpulse.org/city-council-proposes-sugar-sweetened-beverage-tax/. Accessed February 26, 2013.

67 San Francisco Chronicle Editorial Board. (2012, October 19). A sour deal: Chronicle recommends no soda tax. San Francisco Chronicle, A17.

68 Opponents of soda tax measure spend $2.2M. (2012, October 10). Desert Sun, C3.

69 American Beverage Association. (2012, November 7). The day after. http://www.ameribev.org/blog/2012/11/the-day-after/. Accessed March 6, 2013.

70 Harless W. (2012, June 13). Beverage lobbyist funds “community” campaign against soda tax. California Watch. http://californiawatch.org/dailyreport/beverage-lobbyist-funds-community-campaign-against-soda-tax-16585. Accessed February 19, 2013.

71 Velazquez M. (2012, July 23 ). El Monte Council to consider fiscal emergency, “sweet” tax for November ballot. San Gabriel Valley Tribune.

72 Onshi N. (2012). California city savors role in fighting “Big Soda.” New York Times. http://www.nytimes.com/2012/11/05/us/richmond-calif-savors-role-as-soda-tax-battleground.html?pagewanted=all. Accessed April 16, 2013.

73 Madden L. (2012, November 19). BAPAC and community coalition celebrate election day. Post News Group. http://postnewsgroup.com/blog/2012/11/19/bapac-and-community-coalition-celebrate-election-day/. Accessed February 19, 2013.

74 Rogers R. (2012, July 15). Bitter fight over sugar: A councilman in Richmond leads an effort to tax sugary drinks. Rich foes line up against him. Los Angeles Times, A21.

75 Impuesto a bebidas desata intensa pelea. (2012, November 3). La Opinion. http://www.laopinion.com/Impuesto-a-bebidas-desata-intensa-pelea. Accessed January 15, 2014.

76 Citrin J, Martin IW. (2009). After the tax revolt: California’s Proposition 13 turns 30. Berkeley Public Policy Press.

77 Palmer C, Diaz R. (2013, February 14). New California Field Poll shows support for “soda tax.” San Jose Mercury News. http://www.mercurynews.com/ci_22586019/new-statewide-field-poll-shows-support-soda-tax. Accessed December 4, 2013.

78 Hartocollis A. (2010, July 2). Failure of state soda tax plan reflects power of an antitax message. New York Times. http://www.nytimes.com/2010/07/03/nyregion/03sodatax.html. Accessed January 15, 2014.

79 Food Trade News. (2010). Mayor Nutter’s Philly beverage tax dead before arrival. http://best-met.com/news/mayor-nutters-philly-beverage-tax-dead-before-arrival/. Accessed December 4, 2013.

80 Rogers R. (2012, December 14). Richmond Councilman Ritterman leaves legacy of action, deep void in progressive coalition. Contra Costa Times.

81 Jones C. (2012, November 7). Measure N, sugary drinks tax, losing by a lot; Richmond. San Francisco Chronicle, A18.

82 Rogers R. (2012, July 10). Big Soda cast as Big Tobacco for 21st Century. The Hawk Eye, 2C.

83 Wallack L, Woodruff K, Dorfman L, Diaz I. (1999). News for a change: An advocate’s guide to working with the media. Thousand Oaks, CA: SAGE Publications.

84 Rogers R. (2013, November 1). Richmond activists celebrate as Mexico passes soda tax similar to one that failed locally. Contra Costa Times. http://www.contracostatimes.com/west-county-times/ci_24438036/richmondleaders-celebrate-mexico-passes-soda-tax-similar. Accessed December 10, 2013.

85 Satran J. (2013, February 28). Soda tax proposal comes back from the dead in Vermont. Huffington Post. http://www.huffingtonpost.com/2013/02/28/soda-tax-vermont_n_2784771.html. Accessed December 10, 2013.

86 Miller E. (2013, February 7). Soda tax discussed by lawmakers. Hawaii Tribune Herald. http://hawaiitribune-herald.com/sections/news/local-news/soda-tax-discussed-lawmakers.html. Accessed December 10, 2013.

87 Yudell M. (2012, March 14). Mr. Mayor, try for that soda tax again! Philadelphia Inquirer Online. http://www.philly.com/philly/health/Mr-Mayor-try-for-that-soda-tax-again.html. Accessed December 12, 2013.

88 Lagos M, Cote J. (2013, November 18). SF supervisors double down on soda tax. San Francisco Chronicle. http://www.sfgate.com/bayarea/article/S-F-supervisors-double-down-on-soda-tax-4992359.php. Accessed December 10, 2013.

89 Adams S. (2013, August 8). Telluride council sends sugary beverage tax question to ballot. The Watch. http://www.watchnewspapers.com/view/full_story/23306740/article-Telluride-Council-Sends-Sugary-Beverage-Tax-Question-to-Ballot?instance=search_results. Accessed December 10, 2013.

90 American Nonsmokers’ Rights Foundation. (2004, November). Ballot measures. http://www.no-smoke.org/document.php?id=242. Accessed December 6, 2013.

91 Goldstein H. (2013, May 20). Why a soda tax makes sense: Opinion. Los Angeles Daily News. http://www.dailynews.com/general-news/20130521/why-a-soda-tax-makes-sense-opinion. Accessed December 6, 2013.

References from summary of frames

i Smith C, Ritterman J. (2012, September 30). Point-counter point: Richmond Measure N soda tax. Halfway to Concord. http://www.halfwaytoconcord.com/point-counter-point-richmond-measure-n-soda-tax. Accessed February 25, 2013.

ii Nestle M. (2012, October 11). Big Soda vs. Richmond City Council. Food Politics. http://www.foodpolitics.com/2012/10/big-soda-vs-richmond-city-council Accessed February 25, 2013.)

iii Allen S. (2012, October 29). Ad blitz aims to drown soda tax: El Monte mayor saw measure as a slam dunk. Then the drink makers declared war. Los Angeles Times, A1.

iv Beverage industry spending millions to defeat Richmond soda tax. (2012, October 9). CBS San Francisco. http://sanfrancisco.cbslocal.com/2012/10/09/beverage-industry-spending-millions-to-defeat-richmond-soda-tax. Accessed February 19, 2013.

v Barrera E. (2012, December 15). Sugary drinks are a health hazard. Pasadena Star News.

vi Croom K. (2011, December 18). City Council proposes sugar sweetened beverage tax. Richmond Pulse. http://richmondpulse.org/city-council-proposes-sugar-sweetened-beverage-tax/. Accessed February 26, 2013.

vii Rogers R. (2012, July 10). Big Soda cast as Big Tobacco for 21st century. The Hawk Eye, 2C. viii Harless W. (2012, August 9). Soda industry outspends beverage tax supporters 10-1 in Richmond. California Watch. http://californiawatch.org/print/17454. Accessed February 20, 2013.

ix National Association of Convenience Stores. (2012, July 6). Richmond soda tax fight heats up. http://www.nacsonline.com/News/Daily/Pages/ND0706121.aspx#.Uqeeqo0mz1g. Accessed December 10, 2013.

x Velazquez M. (2012, October 8). El Monte to spend roughly $100,000 to place “soda tax” on special election ballot. San Gabriel Valley Tribune.

xi Could Richmond be the first California city to tax soda? (2011, December 7). KQED: State of Health. http://blogs.kqed.org/stateofhealth/2011/12/07/could-richmond-be-first-california-city-to-tax-soda/. Accessed February 25, 2013.

xii Early S. (2012, November 7). Getting into bed with Big Soda: How labor helped win a vote for more obesity. Huffington Post. http://www.huffingtonpost.com/steve-early/richmond-soda-tax_b_2089732.html. Accessed February 20, 2013.

xiii Whitney S. (2012, July 7). Debate pops over Richmond soda tax. Post News Group. http://www.postnewsgroup.com/publishedcontent/2012/07/21/debate-pops-over-richmond-soda-tax/. Accessed February 19, 2013.

xiv Reardon J. (2012, October 11). Letters to the editor: Yes on Measure N provides a solution. Contra Costa Times. xv Smith C. (2012, May 24 ). Letters to the editor: Richmond’s ‘sugar tax’ is the wrong approach. Contra Costa Times.

xvi Velazquez M. (2012, July 28). Experts and business advocates weigh in on El Monte’s soda tax proposal. San Gabriel Valley Tribune.

xvii Kenyon A. (2011, December 13). Richmond moves forward with soda tax. The Bay Citizen. http://www.baycitizen.org/news/health/richmond-soda-tax-obesity-health. Accessed February 19, 2013.

xviii Suwalsky A. (2012, September 21). Richmond: At the forefront of the childhood obesity discussion. Richmond Pulse. http://richmondpulse.org/at-the-forefront/. Accessed February 26, 2013.

xix William-Ross L. (2012, November 7). The Big Gulp: Voters reject soda tax in El Monte. LAist. http://laist.com/2012/11/07/voters_reject_soda_tax_in_el_monte.php. Accessed February 27, 2013.

xx Jones C. (2012, November 8). Soda tax, council races draw cash. San Francisco Chronicle.

xxi Carter B. (2013, January 5). Dr. Brazell Carter: Where do we go from here on combating obesity? Contra Costa Times. xxii States News Service. (2012, September 7). Two California cities tackle soda taxes. http://www.highbeam.com/doc/1G1-301837878.html. Accessed February 11, 2014.

xxiii Harless W. (2012, June 13). Beverage lobbyist funds “community” campaign against soda tax. California Watch. http://californiawatch.org/dailyreport/beverage-lobbyist-funds-community-campaign-against-soda-tax-16585. Accessed February 19, 2013.